Aam Aadmi Bima Yojana (AABY) A Social Security Scheme

The Government of India has implemented several welfare schemes for workers in the unorganized sector and people living below the poverty line (BPL) Aam Aadmi Bima Yojana (AABY) is also important This scheme is for those families who are at risk such as accidents sudden death or permanent disability Through this scheme families dependent on the unorganized sector get money

Introduction to the Scheme

In 2007 the Government of India launched the Aam Aadmi Bima Yojana It is to provide insurance cover to people working in the unorganized sector who are often deprived of any kind of social security In this scheme not only insurance protection is given but educational scholarships are given to children so that the family can get more money This scheme is especially designed for people who are slightly above the poverty line or fall in the BPL category

Eligibility

Some specific eligibility is required to avail the benefits of this scheme

Adult age: People between 18 and 59 years can avail the benefits of this scheme.

Economic condition: The benefits of the scheme are mostly available in the BPL category People of the poverty line get this benefit but sometimes poor families above the poverty line can also be eligible

Business: This scheme is especially for people working in the unorganized sector like agricultural workers fishermen weavers handicraftsmen and other risk-prone people

Premium

The annual premium of each member in Aam Aadmi Bima Yojana is just ₹200 The central government collects 50 percent of this premium of one hundred rupees while the state government nodal agency or any related organization pays the other 50 percent This low premium rate makes the scheme more suitable so that people with weak economic condition can also benefit from it

Insurance coverage

The following insurance coverage is included in this scheme

Natural death: If a member dies a natural death, then his family will get Rs 30,000

Accidental death or total disability: In case of death or total disability due to an accident, an assistance of ₹75,000 is given

Partial permanent disability: If partial permanent disability occurs due to an accident, then ₹37,500 will be paid

This scheme is very beneficial for families whose sole earning member suddenly dies or becomes disabled. With this the family can meet their daily needs and their money remains safe

Educational Scholarship

Apart from insurance protection Aam Aadmi Bima Yojana also provides educational scholarship. Under this program, two children of the family who are studying in class 9 to 12 are given a scholarship of ₹100 per month This amount is given every year from 1 July to 1 January Its purpose is to help the education of children so that the financial pressure on their family can be reduced and the children can continue their education independently

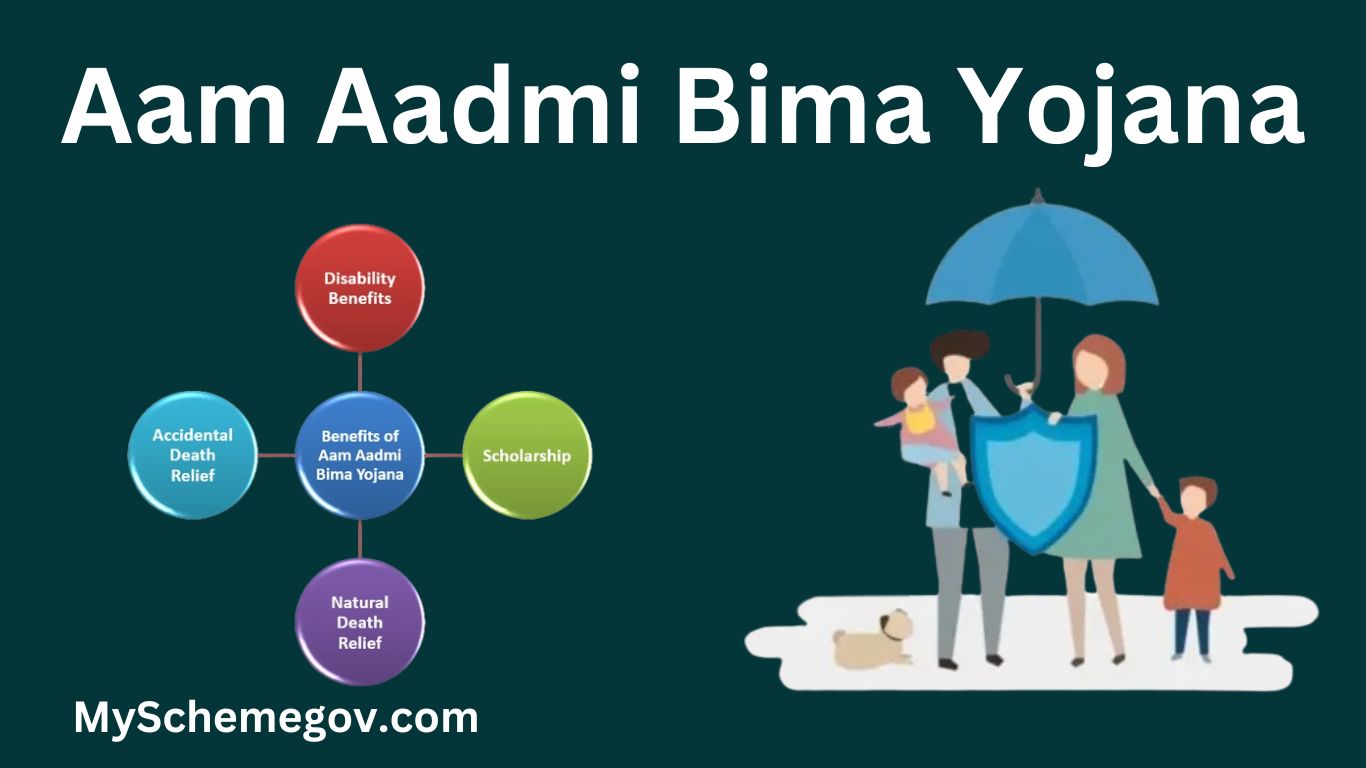

Benefits of the scheme

1. Money Protection: This scheme gives money for families whose sole earning member dies or becomes disabled due to accident or illness

2. Low Expenses: Getting such a comprehensive insurance protection at an annual premium of ₹200 is a big benefit which makes it very beneficial for financially weak people

3. Government Help: This scheme is for common people Beneficial because the central and state governments bear part of the premium

4. Education Assistance: An important part of this scheme is to provide the opportunity of higher education to the children of the family by giving scholarships to the children

Challenges of the Scheme

While Aam Aadmi Bima Yojana has many benefits, there are some challenges in making it fully successful

Lack of information: Many eligible people do not take advantage of the scheme due to lack of knowledge about it. Very little is known about it, especially in rural areas

Paperwork: Getting insurance claim can be difficult as illiterate or less educated people need to do a lot of paperwork

Delay of concerned agencies: Eligible individuals do not get insurance due to not depositing the premium on time by the state government or nodal agency regularly

Claim Process

To get the insurance amount under Aam Aadmi Bima Yojana the nominated family member has to submit some necessary documents. These include nomination letter receipt of premium payment, death certificate or disability certificate. These documents have to be given to the concerned insurance company or nodal agency After this, the insurance amount is given to the concerned family if all the documents are correct

1. Aam Aadmi Bima Yojana

Aam Aadmi Bima Yojana is a social security program for the poor and people working in the unorganized sectors. The Government of India launched it in 2007 with the aim of providing financial assistance in case of accidental death or disability. Eligible families get insurance cover from this program which covers disability, accidental death and natural death. Also, scholarships are given to the children so that the families can get money.

2. Aam Aadmi Bima Yojana in English

The Government of India launched the Aam Aadmi Bima Yojana (AABY) which is a social security program. It is designed to provide life insurance coverage to people living in the unorganized sectors and living below or slightly above the poverty line. This scheme gives financial assistance in case of natural death, accidental death or disability. ABAY also has an educational scholarship to support the education of the children of the insured person which provides financial assistance to families facing challenging circumstances.

3. Aam Aadmi Bima Yojana LIC

Life Insurance Corporation of India (LIC) implements the Aam Aadmi Bima Yojana. LIC provides insurance cover under this scheme and gives insurance benefits to the beneficiaries. The central government pays 50 percent of the premium while the rest is paid by state governments or nodal agencies. This scheme is for those who work in unorganized sectors and need social security.

4. Aam Aadmi Bima Yojana LIC Policy Status

Beneficiaries can contact the nearest branch of LIC to know the policy status of Aam Aadmi Bima Yojana. Policy status can also be checked on the official website of LIC. Policyholders can also get information from the concerned state government body or nodal agency. Policy number and other details are required to know the status of the policy.

5. Aam Aadmi Bima Yojana Scheme

The government program Aam Aadmi Bima Yojana aims to provide insurance cover to the poor and people of unorganized sectors. Rs 30,000 is given on natural death, Rs 75,000 on accidental death and Rs 37,500 on partial disability. Apart from this, children get insurance for education. Scholarships are also given for this which gives money to the families. This scheme has given great relief to both urban and rural poor.

6. LIC Aam Aadmi Bima Yojana

LIC implements the Aam Aadmi Bima Yojana under which eligible families get insurance cover. In this scheme, financial security is provided to the poor and workers of the unorganized sector. The central and state governments also bear part of the premium so that the benefits of the scheme can reach as many people as possible. LIC provides timely insurance claims to the beneficiaries so that they can get relief from sudden financial crises in their lives.

7. Aam Aadmi Bima Yojana Claim Form

The beneficiary or nominee has to fill the claim form in LIC or nodal agency. Death certificate or disability certificate, Aadhar card and bank details also have to be attached to this form. LIC gives the insurance amount to the eligible family on completion of the claim process. Claim form can be obtained from LIC branches or from the concerned agency.

Conclusion

Aam Aadmi Bima Yojana, an important scheme of the Government of India, provides financial security to employees working in the unorganized sector and poor families. This scheme provides financial security to the families. Protects the poor from the risk of disability and death. To make the scheme more effective, awareness should be increased and paperwork should be made easy. If these obstacles are removed, then Aam Aadmi Bima Yojana can really improve the lifestyle of the poor and people working in the unorganized sector.

So that more and more people can benefit from this scheme, its wide implementation and awareness campaign should be done in both urban and rural areas.

Samajik Suraksha Pension Yojana Mp

FAQs:

1. Aam Aadmi Bima Yojana

The poor and low-income group people of the unorganized sector get the government scheme Aam Aadmi Bima Yojana. Insurance cover is provided in case of death, accident or disability so that the affected family can get money.

2. Aam Aadmi Bima Yojana in English

Aam Aadmi Bima Yojana (AABY) is called “Aam Aadmi Bima Yojana” in English. Its goal is to provide life insurance and disability insurance to the poor and people living in the unorganized sectors so that they and their families can get money in difficult times.

3. Aam Aadmi Bima Yojana LIC

Life Insurance Corporation of India (LIC) implements Aam Aadmi Bima Yojana. LIC is the owner of this scheme. Provides insurance cover to the people enrolled in the scheme and implements it successfully in collaboration with the government

4. Aam Aadmi Bima Yojana LIC Policy Status

Beneficiaries can visit the nodal agency or LIC office to know the status of LIC policy under Aam Aadmi Bima Yojana, for this, necessary details including policy number have to be given

5. Aam Aadmi Bima Yojana Scheme

Aam Aadmi Bima Yojana is an important government scheme that provides insurance protection to the poor families of the unorganized sector. Under this scheme, financial assistance is given in disability, accident or natural death.

6. LIC Aam Aadmi Bima Yojana

LIC is very important in implementing the Aam Aadmi Bima Yojana. It provides insurance to eligible people and delivers insurance benefits to the enrolled persons.

7. Aam Aadmi Bima Yojana Claim Form

A claim form is filled by LIC to claim under Aam Aadmi Bima Yojana. It requires other necessary documents along with confirmation of death or disability, after which the insurance amount is given to the beneficiary.

1 thought on “Aam Aadmi Bima Yojana”